- Market Navigator

- Posts

- My last idea for a few days is...

My last idea for a few days is...

Meet me in the chat room

*together with ProsperityPub

“Thanks Jeffrey Turnmire”

Jeff Bishop Learned His 0DTE Strategy

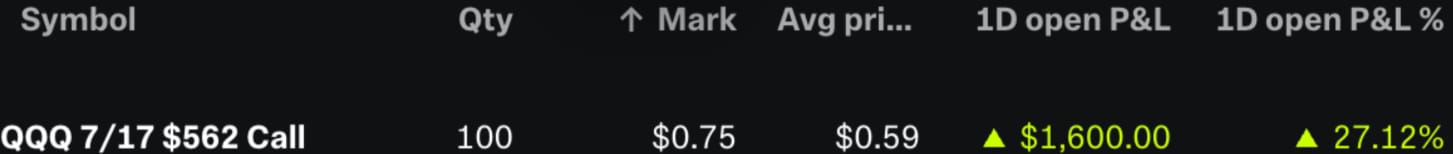

Took A REAL-TIME Trade

🔥BOOM, 30 Minutes!🔥

*note: trading is hard, results not guaranteed and should not be expected to be replicated typically.

Good morning all and happy Friday,

We made it once again to the end of the week and man has it been a good one for Market Navigator, Mission to Million and Atomic Trades! If you have any questions about these trading services of mine please just give our support staff a ring at 1-800-585-4488

Alright, a quick note that I will be out of town from July 21 - 25th and I’ll resume my trading on July 28th.

So, how has the SPY been trading this week and what is my FINAL trade for today?

SPY Midweek Review – Week of July 14–18, 2025

Performance & Market Context

SPY is up ~0.57% so far this week, continuing a broader rally that has pushed the S&P 500 higher .

The industrial sector is a key growth driver: S&P 500 industrials are up ~15% YTD, outpacing the broader index’s ~7% gain, and boosting the performance of SPY

Earnings ramp-up is setting the stage for continued upside, especially with major names like Alphabet and Tesla reporting soon

Intraday Behavior & Volatility

Historically, SPY tends to see its strongest hourly returns between 11 AM–12 PM ET (65% of days positive), with some of this week’s momentum occurring then

Today, the ETF opened slightly higher, posted gains by lunchtime, and edged up further into the afternoon session .

Technical Setup

Year-to-date, SPY is up roughly 12–13%, and has gained ~4.6% over the past month TradingView.

Technical indicators are neutral to bullish, with some analysts viewing the 620–628 range as a key trading corridor

Macro Tailwinds & Risks

Industrial strength is lending traction to the rally, driven by heavy gains in aerospace, machinery, and defense sectors

However, watch for macro warning signs:

Upcoming industrial and tech earnings

Tariff discussions (with potential changes by August 1)

Interest rate policy—especially as the Fed meets July 29–30

What do I plan to trade today to close the week? Well, as of right now I have my eyes on July 26 SPY $626 calls for the move to $630s today on SPY.

Join me in the chat room this morning and again at 3pm ET, just click the button below to take your seat:

What’s on your radar?

What’s your ideal weekend activity? |

🥂Haven’t joined RB Special Events yet? Change that by subscribing HERE.

P.S. As always, for questions about any of our services, contact our amazing sales team at 1-800-585-4488 / [email protected]. They’d love to hear from you!

DISCLAIMER: To more fully understand any Ragingbull.com, LLC ("RagingBull") subscription, website, application or other service ("Services"), please review our full disclaimer located at https://ragingbull.com/disclaimer.

*Sponsored Content: If you purchase anything through a link in this email other than RagingBull (RB) services, you should assume that we have an affiliate relationship with the company providing the product that you purchase, and that we will be paid in some way. RB is not responsible for any content hosted on affiliate’s sites and it is the affiliate’s responsibility to ensure compliance with applicable laws. We recommend that you do your own independent research before purchasing anything. While we believe in the companies we form affiliate relationships with, please don’t spend any money on these products unless you believe they will help you achieve your goals.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any RagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, trading results of third parties have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor(IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.

In the event that any suit or action is instituted as a result of doing business with RagingBull.com, LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.