- Market Navigator

- Posts

- Tariff truce & AI juice 🤝🤖

Tariff truce & AI juice 🤝🤖

This stock looks poised to roll...

Sponsored by Sica Media and Disseminated on Behalf of DataVault AI*

TODAY’S TOP ALERT!

Datavault AI (Nasdaq: DVLT)

👉DVLT is TODAY’S #1 ALERT👈

Good morning, Folks, Jeff Bishop here.

The Market continues to grind higher (to the dismay of bears 🐻), fueled by positive tariff news and remarkably resilient earnings reports, so far at least.

Don’t let the trading action lull you to sleep though. We still have a major wave of earnings announcements coming from AMZN, MSFT, META, and AAPL, which report over the next few days.

I expect those reports to set the tone for the market for at least the next week.

However, I have to wonder… why even worry about how those reports will land?

If you have been paying attention to my “tactical ideas.” you have seen some blistering moves that have absolutely crushed the market returns over the same period.

Nothing is without risk though, of course, but these smaller momentum ideas have been leading to some incredible moves lately – and I am hoping for more of the same with today’s latest idea.

My idea today is an old standby…

When I alerted it in late December, it surged 17% in the two trading days that followed.

But that was nothing compared to when I revisited it in mid-February. It blasted 53% higher that day!

💥My “tactical” idea of the day is Datavault AI Inc. (DVLT).

If the name isn’t familiar, that’s because the company officially rebranded from WiSA Technologies the day after I last alerted it.

The main reason you need to pay attention to DVLT today is because of the massive news they just dropped regarding a tie-up with IBM.

Datavault AI just rolled out a commercial‑grade version of its DataScore and DataValue AI agents built on IBM’s watsonx platform, with Big Blue lending its engineers to help streamline clients’ financial modelling, risk assessment and pricing across on‑prem, cloud and hybrid setups.

As an IBM Partner Plus platinum member, DVLT will work with IBM on deployment and testing to push AI adoption into finance, healthcare, sports, entertainment and government, and CEO Nathaniel Bradley is calling it a pivotal step toward scaling the company’s data‑monetization platform worldwide.

IBM exec Biz Dziarmaga says the tie‑up marries IBM’s tech with DVLT’s innovations to create new revenue streams for customers, which makes sense given McKinsey’s forecast that generative AI will add $2.6‑$4.4 trillion annually to the global economy.

If you ask me, the stock chart looks absolutely explosive right now.

A couple of weeks ago, you’ll notice DVLT quietly went on a 50% run over a few days.

Now, after consolidating a bit, I think today’s news could be the catalyst for another move higher.

In fact, the stock is already trading up very nicely in pre-market activity.

I think it merits a good, hard look today.

👉 DVLT is TODAY’S #1 ALERT 👈

Let me explain more about what is going on here…

For one thing, part of the deal was stock compensation for DVLT’s new CEO vested on “aggregate revenue equaling or exceeding $40 million over any trailing 12 calendar month period ending on or prior to the date that is 5 years from the grant date.”

This suggests considerable confidence in significant revenue growth potential given that WiSA’s pre-combination revenue for Q3 2024 was $1.2 million.

The company now has two divisions: Data Science and Acoustic Science.

The Acoustic Division stems from WiSA Technologies’ legacy as an innovator in wireless audio technologies for smart devices and next-generation home entertainment systems.

The company overcame the limitations of Bluetooth connections — high latency and “lossy” audio fidelity — with a dedicated wireless network that transmits up to eight channels of high-definition, uncompressed 24-bit 48/96 kHz sound.

(CD quality, for comparison, is only 16-bit and 44.1kHz.)

The result is incredibly high-fidelity audio with no perceivable latency.

And because the tech can deliver so many audio channels, it can bring a true movie-theater experience to the living room.

That’s why the company’s technologies are integrated into products from more than 30 brands, including premium names such as LG, Bang & Olufsen, and JBL. You can see a selection of WiSA-enabled speakers here.

Over the past year, especially, the company has been executing huge licensing agreements with HDTV providers to incorporate its technology.

As of mid-2024, the agreements covered 43% of the HDTV market that uses the Android operating system.

These deals helped the company’s revenue grow 240% from Q2 2024 to Q3 2024 and its gross margin to jump from 3.2% to 19.3%.

But in September, the company dropped news that launched its stock into the stratosphere: An asset purchase agreement to acquire intellectual property and information technology from privately-held Data Vault Holdings Inc.

The deal officially closed on December 31.

This was almost like a SPAC deal, with Data Vault’s assets dwarfing WiSA’s.

A fairness opinion valued Data Vault’s assets between $266M and $501M whereas, prior to the combination, Yahoo Finance gave WiSA a market cap of just $17M.

The company then-CEO Brett Moyer said the deal “marks a turning point in the company’s history, as this transaction will transform the company into a dramatically larger entity with a broad reach in multiple, rapidly growing markets.”

Mr. Moyer is now the CFO of the combined company. Data Vault’s co-founder, Nathaniel T. Bradley, is the new CEO.

Mr. Bradley is a serial entrepreneur and inventor with more than 15k LinkedIn followers.

His experience includes a role as the Chief Technology Officer for Marathon Patent Group — now Marathon Digital Holdings (MARA), which has a current market cap of $4.2 billion.

He has been featured in Forbes, Fortune, and seen on:

Data Vault is the source of the combined company’s Data Science division.

This division uses Web 3.0 technologies, including blockchain and high-performance computing, to offer solutions for data valuation, monetization, and secure management across industries such as biotech, education, and fintech.

The goal is to help companies unlock the full value of their data assets.

You can see some of the division’s key applications under the “Industries” menu item on the company website, but some recent highlights include:

A January 22 agreement with the National Football League Alumni (NFLA) to provide it with “immutable and optimized tokens through the use of our patented data management and AI.”

A February 18 “expanded presence” in academic credential verification via its VerifyU platform. VerifyU “empowers institutions to recognize and verify the achievements, skills and credibility of their students through immutable, blockchain-based credentials.”

A March 17 revelation of a “multi-year commercial and intellectual property (IP) alliance with NYIAX, a pioneer in transparent trading technology built on the Nasdaq financial framework.” The goal is to enable “a new era of AI-driven data monetization.”

DVLT is now a bleeding-edge company with a lot of hot irons in the fire…

At CES 2025 — probably the biggest tech event in the country, with more than 141,000 attendees — the company revealed patented Web 3.0 innovations that were featured in Forbes’ “14 Highlights From CES 2025.”

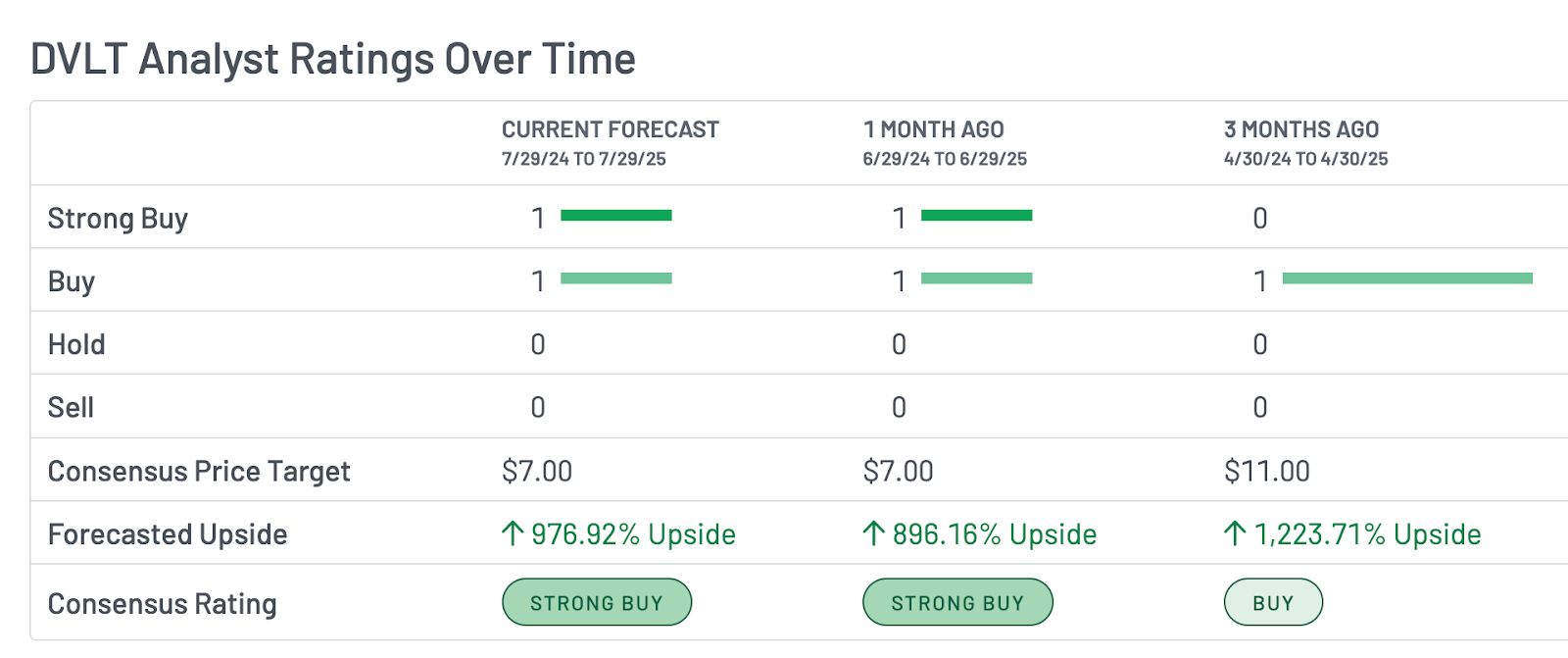

The average consensus price target over the next 12-month price on DVLT is $7.00 — which would be a massive 900% upside from its current price.

Folks, that’s a nearly 10-bagger opportunity.

For details on what the merged company will be up to, check out this investor presentation released in January as well as the company website.

And of course, be sure to do more of your own research.

Always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: DVLT has surged 50% in the past two weeks, and with a 7% gain on Friday, the wind is at its back.

The company just expanded dramatically with its combination with Data Vault, and one analyst sees it as a nearly 10 bagger opportunity from its current price point.

💥Stay locked in on DVLT today to see how far this momentum takes it!

To Your Success,

Jeff Bishop

DISCLAIMER: This entity is owned by Ragingbull. com, LLC ("RagingBull"). To more fully understand any RB subscription, website, application or other service, please review our full disclaimer located at https://ragingbull.com/disclaimer.

We are disseminating this report on behalf of Sherwood Ventures (SV). Sherwood’s full disclaimer is found here: https://bullseyealerts.com/disclaimer/

Just so you know, what you're reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let's be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren't what you'd call “typical.”

Just a quick heads up about this ad you're reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received thirty five thousand thousand dollars (cash) from Sica Media for advertising Datavault AI Inc (previously, WiSA Technologies), Inc for a one day marketing program on July 29, 2025. Additionally, we received twenty five thousand thousand dollars (cash) from Sica Media for advertising Datavault AI Inc (previously, WiSA Technologies), Inc for a one day marketing program on March 24, 2025. Prior to this, we received fifteen thousand dollars (cash) from Sica Media for advertising WiSA Technologies, Inc for a one day marketing program on February 12, 2025 and we also received twenty five thousand dollars (cash) from Sica Media for advertising WiSA Technologies, Inc for a one day marketing program on December 26, 2024 and another twenty five thousand dollars (cash) from Sica Media for advertising WiSA Technologies, Inc for a one day marketing program on September 26, 2024 and also seventeen thousand five hundred dollars from Sica Media for a one day marketing program on April 19, 2024. It might seem obvious, but while our client claims not to own any shares in Datavault AI Inc, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Datavault AI Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there's exceptional risk involved in trading. This isn't small potatoes we're talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We're shining a light on the good stuff about the company here, but it's on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we're not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can't wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who's licensed to give you real advice. To be clear,

Neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that's the scoop! If you're intrigued and want to learn more about the companies we talk about, hit up the SEC's website to dig into their filings and see the full picture.